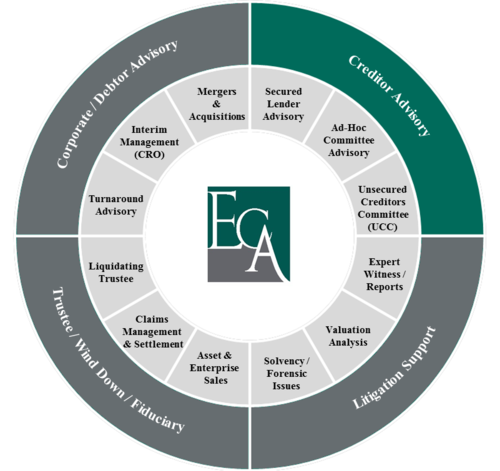

CREDITOR ADVISORY

Emerald has a long-standing track record of effectively advocating on behalf of all classes of creditors. For a detailed list of Emerald's prior creditor advisory assignments and experience, please contact us directly.

Secured Lender / Ad-Hoc Committee Advisory

- Emerald professionals have provided the following services, among others, to both secured lenders and bondholders in distressed situations:

- Analyzing short-term / long-term liquidity and creating cash flow forecasts

- Reviewing business plans and creating performance analyses

- Evaluating potential operational restructuring activities

- Assessing risks related to announced turnaround plans or feasibility of all contemplated growth strategies

- Assessing in-court and out-of-court considerations for the company

- Determining the optimal capital structure and debt capacity of the company

- Examining intercreditor dynamics and negotiating with other stakeholders

- Investigating intercompany transactions

- Valuing the company through segment by segment analysis, traditional methodologies, and liquidation analysis

- Assessing overall capabilities of the company’s management

Unsecured Creditors / Equity Committee Advisory

- Emerald is the preeminent financial advisory firm for official court-appointed committees in Chapter 11 bankruptcies.

- Over the last two years, Emerald has represented ten Official Committees.

- Moreover, Emerald professionals have advised over 40 additional Official Committees during the past decade.

- Recent engagements have included §363 asset sales, DIP negotiations, the development of reorganization plans, rights offerings, and valuation and testimony.

- Emerald is an expert in committee representations, balancing the individual needs of stakeholders and promoting their interests through:

- A proven ability to identify unencumbered value;

- A strong valuation record; and

- A reputation for working toward the recoveries on pre-petition investments for stakeholders.

- Emerald employs a relentless, results-driven approach to maximize recoveries for stakeholders of Chapter 11 debtors, which has resulted in first-rate outcomes for its clients.